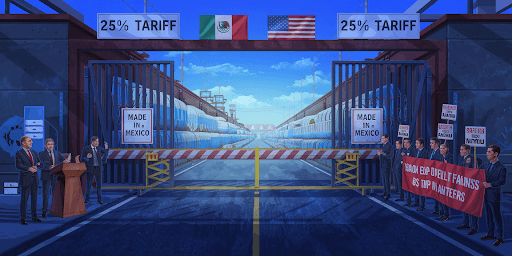

President-Elect Trump’s Tariff Plans for Mexico

On November 25, 2024, US President-elect Donald Trump disclosed his intention to implement additional tariffs on imports from China, Mexico, and Canada. His proposed plan includes a 10% tariff on goods from China and a significant 25% tariff on imports from Mexico and Canada. Trump stated that these measures would be among his first executive orders, set to be signed on January 20, 2025, immediately following his inauguration.

In a series of social media posts, Trump clarified that these tariffs would remain in place until the targeted nations — China, Mexico, and Canada — take definitive actions to curb the movement of drugs and undocumented immigration into the United States.

This announcement has sparked swift reactions from leaders across North America. Mexico’s President Claudia Sheinbaum and Canada’s Prime Minister Justin Trudeau have both expressed strong opposition. They are actively engaging in diplomatic efforts to prevent the tariffs from being imposed on their countries’ exports.

This article examines whether Trump can impose these tariffs on Mexico and explores the potential ramifications for Mexican manufacturing and exports.

Can the U.S. Legally Enforce Tariffs on Mexico?

The United States-Mexico-Canada Agreement (USMCA) establishes a framework for free trade among the three nations, eliminating tariffs on a broad range of products, including agricultural goods. Imposing new tariffs outside of the agreement’s terms would likely violate the USMCA, which explicitly prohibits additional duties unless agreed upon by all parties.

However, there are provisions within the USMCA and U.S. trade law that could allow for tariffs under specific circumstances:

- Essential Security Exception: The USMCA permits tariffs if they are necessary for national security purposes. This clause could potentially be invoked to justify tariffs on Mexican exports.

- National Emergencies or Unfair Trade Practices: U.S. trade laws empower the President to impose tariffs during national emergencies or in response to unfair trade practices.

Despite these possibilities, Mexico and Canada could challenge the legality of such tariffs through the USMCA’s dispute resolution process. Such challenges could delay or even overturn the proposed tariffs.

The USMCA in 2026

The USMCA includes a sunset clause, requiring a review every six years. The next review is scheduled for 2026, providing an opportunity to renegotiate tariff rates or even overhaul the agreement. While it’s unlikely that the agreement would be entirely discarded due to the economic reliance of U.S. border states like Texas and California on cross-border trade, renegotiations could result in changes to tariff structures.

Potential Implications of Tariffs

If the proposed tariffs are implemented, U.S. consumers and businesses are likely to face increased costs. Grocery and agricultural products, such as avocados and other produce exported from Mexico, could see significant price hikes. Additionally, tariffs could strain U.S.-Mexico economic ties and disrupt supply chains.

However, it is more probable that a negotiated settlement will be reached. A blanket 25% tariff on all Mexican and Canadian products would be economically detrimental and politically contentious. Instead, selective tariffs on specific products may emerge as a compromise.

Recent Developments

Mexico and Canada have already taken steps that might influence the U.S. position. For instance, on December 4, 2024,Mexican authorities announced the seizure of a record quantity of fentanyl pills . Such actions demonstrate a willingness to address U.S. concerns and could help soften Trump’s stance on tariffs.

However, it is more probable that a negotiated settlement will be reached. A blanket 25% tariff on all Mexican and Canadian products would be economically detrimental and politically contentious. Instead, selective tariffs on specific products may emerge as a compromise.

How Can Businesses Mitigate Tariff Risks?

For businesses involved in Mexican exports and manufacturing, uncertainty surrounding tariffs necessitates proactive planning. Key strategies include:

- Conducting Cost Analysis: Assess how fluctuations in the Mexican peso could offset potential tariff costs, preserving financial viability.

- Reviewing Service Provider Arrangements: Collaborate with Mexican logistics companies, customs brokers, shelter service providers, and contract manufacturers to leverage duty mechanisms like IMMEX.

- Exploring Free Trade Zones: Take advantage of Mexico’s free trade zones, designed to encourage foreign investment and provide duty-free benefits.

Tariff Strategies with AMREP Mexico

Trump’s proposed tariffs have generated widespread concern and their implementation will face legal and practical hurdles. Businesses must stay informed and prepared to navigate potential disruptions while awaiting clearer policy directions. The upcoming USMCA review in 2026 may serve as a more realistic point for renegotiating tariff terms, emphasizing the importance of long-term planning.

Tariff Strategies with AMREP Mexico

Trump’s proposed tariffs have generated widespread concern and their implementation will face legal and practical hurdles. Businesses must stay informed and prepared to navigate potential disruptions while awaiting clearer policy directions. The upcoming USMCA review in 2026 may serve as a more realistic point for renegotiating tariff terms, emphasizing the importance of long-term planning.

At AMREP Mexico, we are committed to helping businesses adapt to changing trade policies and thrive in the global marketplace. As a Supplier Quality Management Company, we specialize in providing solutions to manage tariff-related challenges, ensuring your business remains competitive while maximizing opportunities. Reach out to us today to learn how we can support your business in this dynamic environment.